Arguably one of the biggest buzzwords for last year and this year 2021 has been “Bitcoin”, a digital currency that solves many of the world’s problems like fast borderless transactions, and the on-going issue of inflation.

For many of you reading this article, this might be the first time you have ever heard of cryptocurrency or maybe gained some interest in getting to know about it from a friend or something. In this article series, I will share my journey of investing in cryptocurrency, my lessons learned (oh they are many), and a short guide on how you can get started on the revolutionary journey of crypto.

Timetravel

If you could travel back in time to the early 2000s and tell everyone that the internet would soon take over companies like Blockbusters the famous movie rental franchise, you’d be brandished crazy. Just as difficult as it was then to even imagine the change the internet could provide for us, the same can be said for cryptocurrency right now.

My journey started in cryptocurrency in 2015 when I wrote my Masters’ thesis on a new and emerging currency called Bitcoin. I remember back then finding sources of information to even write the 10,000 words plus document was a task in itself as hardly anybody had heard of it, talk less of collected data on it. At that time of writing my thesis, Bitcoin was around $220 and Litecoin (another type of digital currency) was 3$.

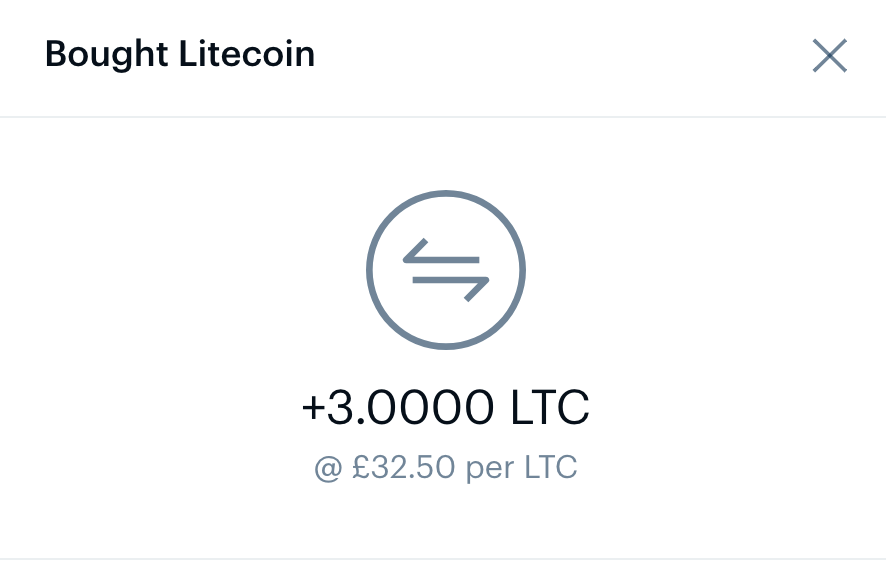

It wasn’t until around 2017 that I actually started to invest financially in cryptocurrency and get in early on the action. One of the first digital currencies I bought was Litecoin and I purchased this for around $33 per coin. I had no idea where it would go to but I knew that I just wanted to hold some in case of something happening. A few weeks later the coin went up to around $60 nearly doubling my investment and as my financial value grew so too did my interest.

Fast forward to 2021 cryptocurrencies have seen a huge bull run (a term meaning a big rally/increase in price) with bitcoin up over 1000% since its last 2018 bull run and it has not seen any signs of slowing down.

How to get started

I’d like to start off by saying this public announcement…(announcement coughs)

This is not financial advice and I am not a financial advisor so please do your own research and don’t just take my word for it.

Ok, now we got that cleared let’s begin, shall we? In the early days of cryptocurrency, it was hard to find information on how to purchase bitcoins and where to store them as various people had fallen victim to scammers looking to capitalize on the growing trend. However today, there are thousands of tutorial videos and Youtube channels to help get you started and provide information… (Caveat: Bear in mind, of course, it is Youtube and as the saying goes “Youtubers will do Youtuber things” which basically means some can say anything for views <— I made that by that way)

Here’s a video you can watch

A few other Youtubers I like are KoroushAk, Quinten and Hardc0re crypt0.

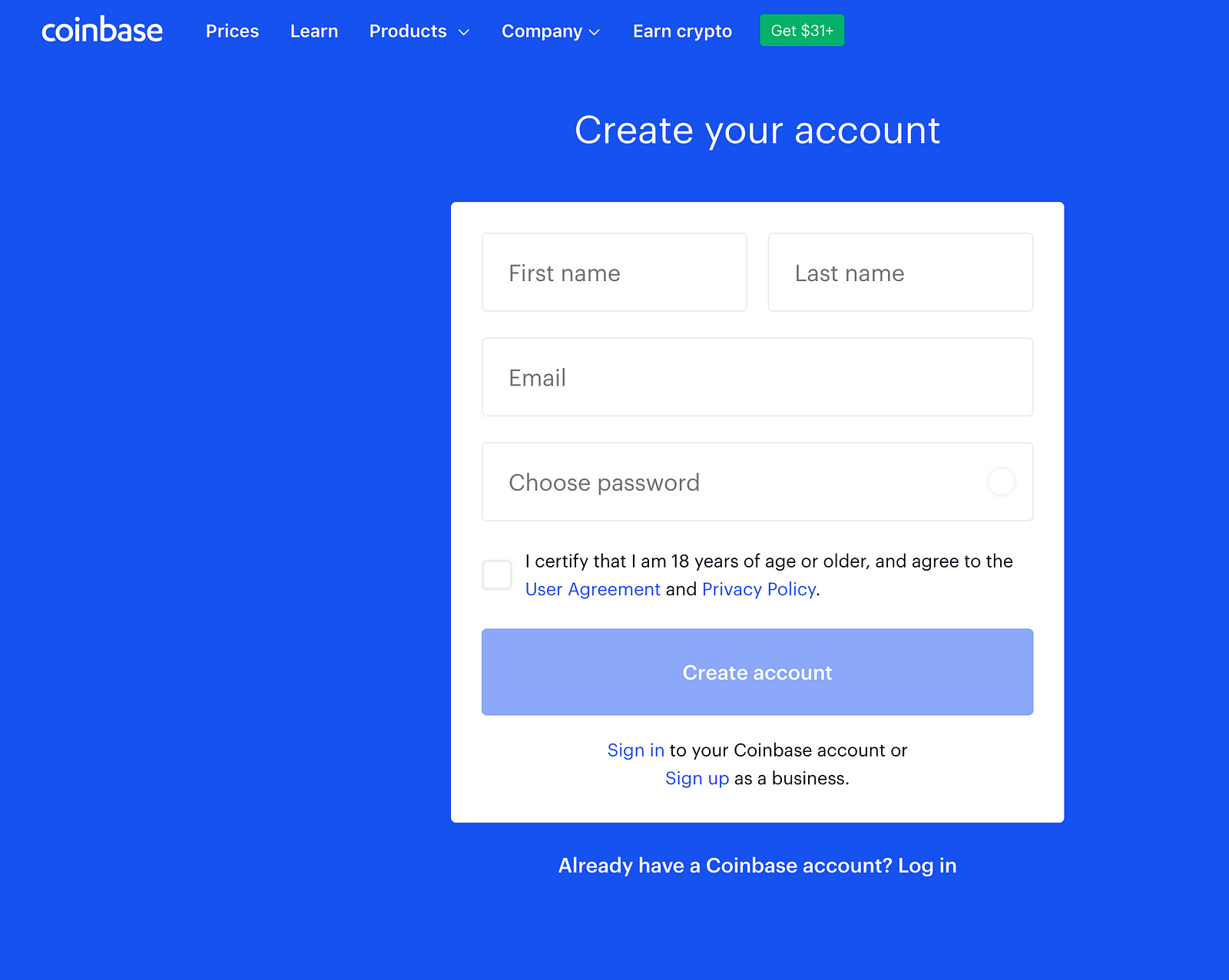

Buying cryptocurrency is as simple as buying a pair of shoes online… literally. First, you need to go to an exchange where you can buy and sell various cryptos. One platform I started of with was Coinbase then I moved to Binance. It’s free, takes less than 2 mins to join and the fees to buy a currency are relatively cheap around a few dollars per purchase (e.g, not a direct conversion — buying $200 worth of bitcoin costs $2 using your bank card).

Alternatively, you can just fund your trading platform account with fiat currency directly ($,£, €, etc) and buy some, that way you save on any transaction fees.

Oh! Here are some links by the way to get a discount when signing up to buy cryptocurrency

‣ Buy and sell crypto on Binance Platform and get a discount (free)

‣ Signup on Coinbase (free)

‣ Coingecko a website to check cryptocurrency prices

Coinbase Signup page

Once you sign up, you’re able to buy cryptocurrencies but if you are looking to make a large purchase like in the thousands then the platform may request some I.D verification information which is just a KYC (know your customer) so they know who you are.

After buying your first currency it will be stored on the online-based platform in what is called a “wallet” similar to a wallet you have in your jeans pocket… or bag if you’re a lady (women jeans don’t really have pockets the size of men, it’s actually worrying, but I digress).

The platform automatically creates a wallet for you and you can use this to receive and send different cryptocurrencies to other wallets with a small fee or zero fees depending on the digital currency. And that’s it! You’ve got your first cryptocurrency.

Even though I produce content for free you never know who could read this and feel they would like to donate some Bitcoin for the knowledge I share so this is my Bitcoin address 😊

3LyERSEXj4KDgJuSvhBQTvLwtcxtn4ntba — -> My bitcoin address

Lesson 101

Life is full of lessons and one of the ways you can learn is by making mistakes. I’ve made too many of them count but from each of them I have come out at the other end different from how I went in. This is no different from cryptocurrency, where you will definitely make mistakes but this is all part of the journey. A valuable lesson I’d like to share involves greed which took the form of holding or hodling (the term used frequently in the crypto-sphere).

Its true that one can hold for too long and be mesmerized by the glamorizng green of a portfolio as this was the case for some Litecoin which I bought at around $30-40 a pop. I remember holding on to this for quite some time and even when it reached a whopping $350 per coin, (more than 10x the price I paid for it), I still didn’t sell or at least take some profits.

One of my early crypto purchases – The good old days

What happened shortly after it peaked, the price came crashing down all the way to around $24. What kept me from selling it when it was $300 per coin was greed. I thought it would just continue to rise and I would be rich beyond my wildest dreams but reality hit me hard and I learnt, in crypto what goes up, can come down just as fast as the market has no emotions and doesn’t care if you win or lose.

In hindsight, I should have taken a decent amount of profit and removed any greed which plagued my mind. A valuable lesson I learnt was to

Always take profit

The lucky part is after a few years, Litecoin rose up again like a phoenix from the ashes and at the time of this writing, is sitting at around $200 a coin — (it’s in a bit of downtrend of 18% which is normal for crypto but almost unheard of in regular stocks). This sheer luck might not be the case for many other coins which have no real financialial backing, team, or fundamental technology which enables them to survive the harsh climate of crypto.

Online and Offline

A common question I’ve seen and been asked online (Twitter) is the question, Can I change my cryptocurrency to my local currency/fiat?

The answer is yes. Similar to the process of buying crypto, selling it is just as straightforward (especially now that institutions are waiting to snap up any cryptocurrency they can get their hands on).

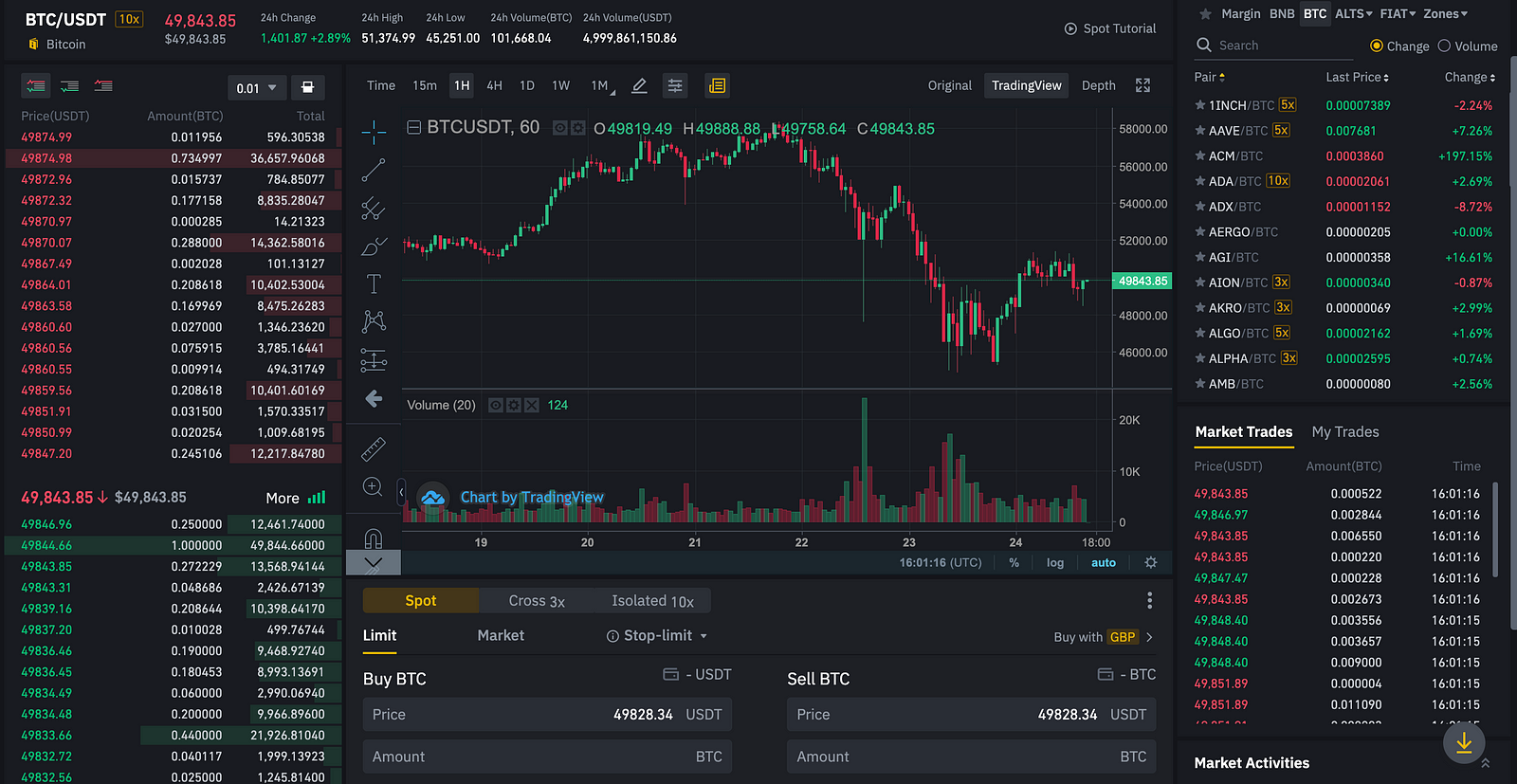

Binance platform to exchange BTC for Fiat

To do this you can either use your platform Coinbase, Binance, etc to exchange your coin straight to your local currency through a pair e.g BTC/USD or BTC/GBP then withdraw the currency through the platform to your bank account for a small fee. (On Binance this is around £1.50 per withdrawal and on the new trading platform FTX withdrawals are free $$$).

Alternatively, you can swap almost any currency for a US dollar-pegged crypto called Tether (USDT). Unlike other cryptocurrencies, since this coin is pegged to a US dollar there is no huge percentage changes so unless the dollar changes then Tether remains pretty much the same.

So you can swap for example ETH/USDT → USDT/”your currency” → Then withdraw from the platform.

Finally, you can make use of cryptocurrency cards which work like normal bank cards and load them up with various cryptos to pay for things, or withdraw cash in pretty much any ATM. A new card on the market to do so is Crypto.com cards which even give you nice APR rates and incentives for using the card like free netflix, spotify, and travel memberships.

Crypto cards

Summary

I truly believe investing in cryptocurrency now is akin to investing in the internet back in the late 90s or early 2000s as the opportunity for disruption in almost all forms is unimaginable. Though of course there will be many pullbacks, FUD (fear, uncertainty and doubt) and a lot of cryptocurrency projects will all of sudden just die out (which is why doing research is important). At the end of the day, cryptocurrency is here to stay and having only just hit a 1 trillion dollar market cap we are only at the beginning of this disruptive digitalization.

“The Journey of a thousand miles begins with a single step”